Proactive Security: Bagley Risk Management Techniques

Proactive Security: Bagley Risk Management Techniques

Blog Article

Just How Livestock Threat Defense (LRP) Insurance Can Safeguard Your Animals Investment

In the realm of livestock financial investments, mitigating risks is vital to making certain monetary stability and growth. Livestock Risk Defense (LRP) insurance coverage stands as a trusted guard against the uncertain nature of the marketplace, supplying a tactical approach to safeguarding your assets. By delving into the complexities of LRP insurance coverage and its diverse benefits, livestock producers can fortify their investments with a layer of protection that goes beyond market changes. As we discover the world of LRP insurance, its role in securing livestock financial investments comes to be significantly obvious, assuring a path towards sustainable monetary durability in an unstable market.

Recognizing Livestock Risk Security (LRP) Insurance

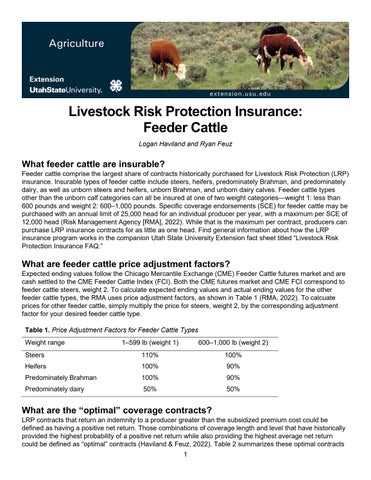

Comprehending Animals Danger Security (LRP) Insurance coverage is crucial for animals manufacturers seeking to minimize monetary risks related to rate variations. LRP is a federally subsidized insurance coverage product created to secure producers against a decrease in market costs. By supplying insurance coverage for market cost declines, LRP helps producers secure a flooring price for their livestock, ensuring a minimal level of revenue despite market variations.

One trick aspect of LRP is its adaptability, permitting manufacturers to customize protection degrees and plan lengths to match their certain requirements. Producers can choose the variety of head, weight array, insurance coverage cost, and protection duration that straighten with their manufacturing goals and risk resistance. Comprehending these customizable alternatives is essential for producers to properly handle their price risk exposure.

Furthermore, LRP is available for different livestock kinds, consisting of cattle, swine, and lamb, making it a flexible danger monitoring tool for animals producers throughout various industries. Bagley Risk Management. By familiarizing themselves with the intricacies of LRP, producers can make enlightened decisions to guard their financial investments and make sure financial stability in the face of market unpredictabilities

Advantages of LRP Insurance for Livestock Producers

Animals manufacturers leveraging Livestock Danger Security (LRP) Insurance policy acquire a critical advantage in securing their financial investments from rate volatility and securing a secure monetary footing amidst market unpredictabilities. One key benefit of LRP Insurance is price security. By setting a flooring on the price of their animals, manufacturers can alleviate the danger of significant financial losses in the occasion of market downturns. This permits them to intend their budgets better and make notified decisions regarding their operations without the continuous concern of price fluctuations.

Additionally, LRP Insurance gives manufacturers with peace of mind. Overall, the benefits of LRP Insurance coverage for livestock manufacturers are considerable, using a beneficial tool for taking care of threat and guaranteeing financial safety in an uncertain market environment.

How LRP Insurance Policy Mitigates Market Dangers

Alleviating market risks, Animals Risk Security (LRP) Insurance coverage supplies animals manufacturers with a trustworthy guard versus price volatility and monetary unpredictabilities. By supplying protection versus unanticipated price drops, LRP Insurance coverage aids manufacturers secure their financial investments and preserve monetary stability in the face of market variations. This sort of insurance policy enables animals manufacturers to lock in a price for their animals at the start of the policy period, ensuring a minimal cost level no matter of market modifications.

Steps to Protect Your Livestock Financial Investment With LRP

In the realm of agricultural danger monitoring, applying Livestock Threat Defense (LRP) Insurance includes a critical procedure to secure investments versus market variations and uncertainties. To safeguard your animals financial investment properly with LRP, the initial step is to assess the particular risks your operation encounters, such as rate volatility or unanticipated weather occasions. Understanding these threats allows you to establish the insurance coverage degree needed to shield your financial investment sufficiently. Next off, it is critical to study and pick a trusted insurance coverage supplier that provides LRP policies customized to your livestock and service requirements. When you have selected a provider, thoroughly evaluate the policy terms, conditions, and coverage restrictions to guarantee they straighten with your danger monitoring objectives. Furthermore, on a regular basis keeping an eye on market patterns and changing your protection as required can aid enhance your defense against potential losses. By following these actions diligently, you can improve the security of your animals investment and navigate market uncertainties with self-confidence.

Long-Term Financial Security With LRP Insurance Coverage

Making certain sustaining monetary stability with the application of Animals Risk Protection (LRP) Insurance coverage is a sensible lasting strategy for farming manufacturers. By including LRP Insurance right into their risk administration strategies, farmers can secure their livestock financial investments versus unpredicted market variations and unfavorable occasions that can endanger their monetary well-being in time.

One trick benefit of LRP Insurance policy for long-lasting financial protection is the tranquility of mind view publisher site it offers. With a trusted insurance coverage in position, farmers can mitigate the financial risks related to unstable market conditions and unexpected losses as a result of factors such as illness episodes or natural disasters - Bagley Risk Management. This stability enables manufacturers to focus on the day-to-day operations of their livestock company without continuous bother with prospective financial problems

Furthermore, LRP Insurance provides a structured approach to managing risk over the long-term. By setting details coverage degrees and picking proper endorsement periods, farmers can tailor their insurance prepares to align with their financial goals and take the chance of tolerance, ensuring a lasting and secure future for their livestock procedures. In final thought, investing in LRP Insurance coverage is a proactive approach for farming manufacturers to accomplish enduring monetary safety and security and protect their livelihoods.

Verdict

Finally, Animals Danger Security (LRP) Insurance coverage is a useful device for animals producers to alleviate market risks and protect their financial investments. By comprehending the benefits of LRP insurance coverage and taking steps to execute it, producers can achieve lasting economic safety for their operations. LRP insurance gives a security internet against price variations and makes sure a degree of stability in an uncertain market environment. It is a smart choice for safeguarding livestock financial investments.

Report this page